This smoking hot real estate market has no signs of slowing down anytime soon! The month of June just had the most signed purchase agreements recorded since way back in 2004. New highs for showings suggest further strengthening, though inventory still remains a challenge.

This smoking hot real estate market has no signs of slowing down anytime soon! The month of June just had the most signed purchase agreements recorded since way back in 2004. New highs for showings suggest further strengthening, though inventory still remains a challenge.

Following is an article published by the Minneapolis Area Association of Realtors.

June signed purchase agreements reach highest level since 2004

(July 16, 2020) – According to new data from the Minneapolis Area REALTORS® and the Saint Paul Area Association of REALTORS®, market activity in the 16-county Twin Cities metro continued to recover from the April and May declines.

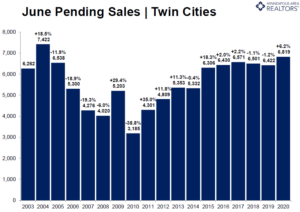

After double-digit declines in April and May, the number of purchase contracts signed in June increased 6.2 percent from last year. That brought the number of pending sales to 6,819 for the month, the highest June figure since 2004. Some of the pent-up demand from April and May was shifted into June instead of being cancelled outright.

Most of the increase was in the single-family segment. Newly built homes also saw a large gain as buyers were eyeing more space and perhaps a second home office, but also found existing options limited. Record low mortgage rates were another motivating factor for buyers—particularly first-time buyers.

“It is still very busy, but there is little inventory,” said Patrick Ruble, president of the St. Paul Area Association of REALTORS®. “Buyers enticed by historically low mortgage rates in April or May can still capitalize on those rates now; however, because there is no inventory we really need to see an increase in listings.”

Sellers are struggling to keep up, though that may be changing. After greater than 20.0 percent declines during April and May, new listings shrank 14.6 percent in June. The share of the list price that sellers received was still down slightly from last year, but at 99.6 percent, it remains at a very high level. The region had 1.8 months of supply in June, indicating a strong and undersupplied sellers’ market. A balanced market has around 5 or 6 months of supply. By contrast, the over $1M luxury segment had more than 11.0 months of supply in June.

“An encouraging showings trend alongside strong demand and a limited supply of homes should continue to support prices,” said Linda Rogers, President of Minneapolis Area REALTORS®. “While still positive, the rate of price growth moderated in May. Now June home price growth is roughly on-pace with the last 12 months.”

“An encouraging showings trend alongside strong demand and a limited supply of homes should continue to support prices,” said Linda Rogers, President of Minneapolis Area REALTORS®. “While still positive, the rate of price growth moderated in May. Now June home price growth is roughly on-pace with the last 12 months.”

The Federal Reserve pushed interest rates on a 30-year fixed mortgage to around 3.0 percent—the lowest figure recorded in more than 50 years. Attractive interest rates can partly offset declines in affordability. Despite that being a motivating factor, the limited supply of homes for sale is one of the biggest challenges for buyers. Sellers are slowly gaining more confidence around health concerns, but a resurgence in COVID-19 cases could dampen that. While condo sales were still lagging, the data shows buyer and seller activity in Minneapolis is comparable to surrounding cities and suburbs.

June 2020 By The Numbers Compared To A Year Ago

- Sellers listed 7,306 properties on the market, a 14.6 percent decrease from last June

- Buyers signed 6,819 purchase agreements, up 6.2 percent (6,118 closed sales, down 8.8 percent)

- Inventory levels fell 29.8 percent to 9,154 units

- Months Supply of Inventory was down 33.3 percent to8 months (5-6 months is balanced)

- The Median Sales Price rose 5.2 percent to $305,000

- Cumulative Days on Market increased 2.4 percent to 41 days, on average (median of 18)

- Changes in Sales activity varied by market segment

- Single family sales were up 10.2 percent; condo sales fell 12.6 percent; townhome sales increased 0.4 percent

- Traditional sales rose 7.1 percent; foreclosure sales dropped 23.2 percent; short sales fell 29.4 percent

- Previously owned sales were up 5.1 percent; new construction sales climbed 35.2 percent

This article can be read in its entirety at: MPLSRealtor.com

Enjoy!

Tom

Leave a Reply